WEIP Advisory Ltd is the company specialized in providing advisory services in M&A projects; operational, financial and ownership restructuring process; project financing. Additionally, it provides services of business analysis and companies’, as well as financial institutions’, valuations; preparation of teasers, feasibility studies for investment projects; and provides consulting services to municipal authority. In cooperation with charted auditor, WEIP Advisory conducts due diligence and valuations of companies and financial institutions and provides consulting services in privatization tenders and tenders for companies’ acquisition. In cooperation with authorized investment company, WEIP Advisory also provides advisory services on capital market projects: arrangement and issuance of securities (IPO), listing on stock exchange, and providing quotation support. Sister companies of the same name in Macedonia, Serbia and Bosnia are registered for the same services.

WEIP Advisory offers the team of professionals, by combining internal and external experts, with the aim of providing optimal service for the client, in particular if special industry knowledge and skills are required.

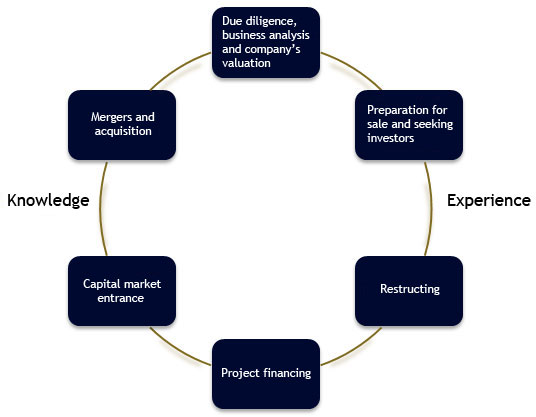

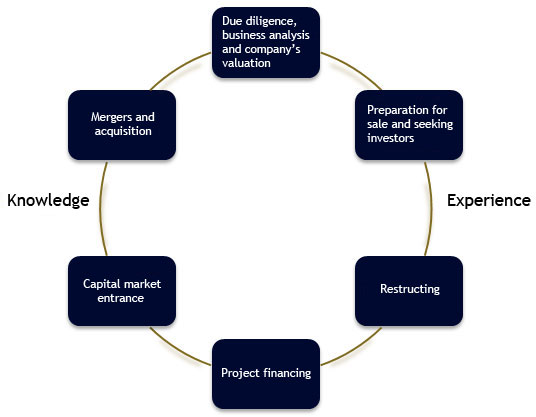

WEIP Advisory services

Mergers and acquisitions (M&A)

Mergers and acquisitions (M&A)

Services relating to M&A include: due diligence, business analysis, Company profile preparation and valuation of companies (in cooperation with charted auditor), preparation of company for sales of business (including abovementioned service), investors’ seeking and organization of sale tenders.

Due diligence, financial analysis, Company profile preparation and valuation of companies/financial institutions (in cooperation with charted auditor)

These services are designed for the buyer, as well as for the seller, in acquisition or sale of the company. Our experience includes big companies with subsidiaries, as well as SME of different industries.

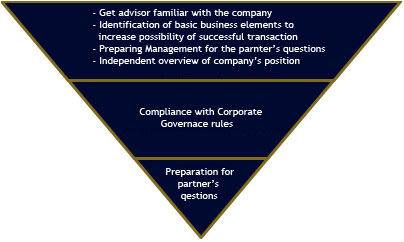

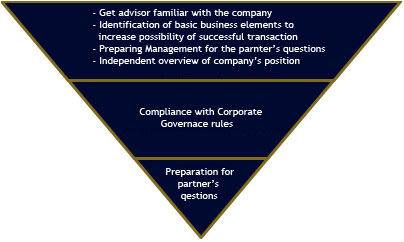

Due diligence process (in cooperation with charted auditor and expert for the specific business sector) provides insight in all relevant aspect of past, present and envisaged future company’s performance. Due diligence starts with preliminary due diligence on the basis of publicly available data, followed by final due diligence on data received from the company. Due diligence is conducted by a team of auditor, lawyer, expert and business consultant. It includes legal, financial and accounting, technical and operational, and ecological due diligence. Financial analysis is done on the basis of due diligence findings and includes possible corrections to financial statement for provisions and adjustments, according to financial and accounting due diligence; horizontal financial statements analysis to determine trends; calculation of certain indicators by groups and comparison with benchmark; business plan valuations. Company profile gives insight into basic info on company.

COMPANY'S DUE DILIGENCE COMPANY'S VALUATION

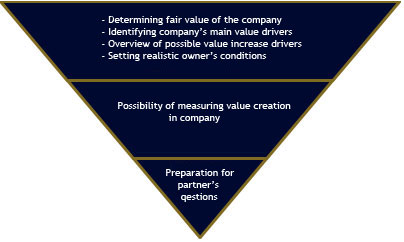

OPTIMAL TERMS OF TRANSACTION MAXIMIZATION OF VALUE

FOR THE OWNER FOR THE OWNER

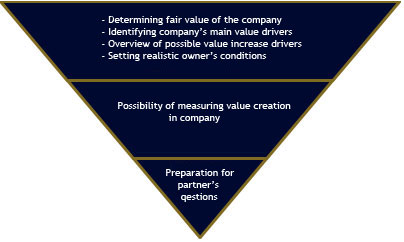

On the basis of due diligence and financial analysis results, as well as projections of financial statements in the medium term period, the company is being evaluated under different valuation methods. The methods used depend on business characteristics and industry sector of the company. Generally used methods are: relative method based on capitalization coefficient of similar companies (shares of comparable companies listed on stock exchange and comparable M&A transactions); assets valuation methods (NAV evaluation – net assets value after adjustments of book value in line with due diligence findings); dynamic methods based on company’s profitability (discontinued cash flow – DCF, and economic value added - EVA); and combined methods (profitability strength + assets – present value of expected cash flows and Stuttgart method).

Valuation of financial institutions includes standards valuation methods: static relative methods using comparable companies and comparable M&A financial institutions' transactions in the region; static method of assets valuation by adjustments to book value of the company (in line with due diligence findings and different operating risk factors); and dynamic valuation methods on the basis of future operating projections, measuring profitability of the bank - discontinued cash flow for financial institutions and Excess Return model (EVA for financial institutions – combined with residual assets' value).

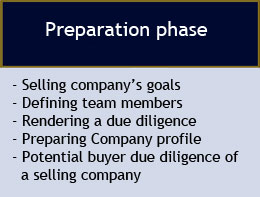

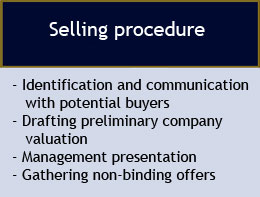

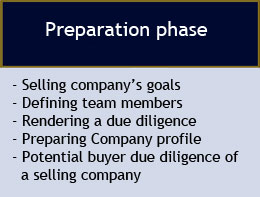

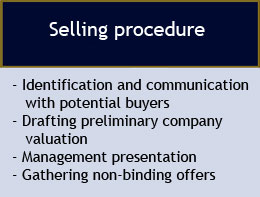

Preparation for Company’s sale of business, investors’ seeking and organization of sale tenders These services are designated for the seller (together with services under 2.1.1.) and include: preparation (due diligence, financial analysis, Company profile and company’s valuation); search for a potential investor or organization of tender in the case of a number of potential investors; managing sale process, with coordination of due diligence performed by the buyer and negotiation over transaction structure and closure.

We have been involved in preparation for sale of many medium sized companies from IT sector, retail, food and wood processing industry, as well as in organization of tender for sale of a few medium sized companies from tourism and industry.

Overview of Sale project phases

Mergers and acquisitions of companies/financial institutions (in cooperation with charted auditor)

WEIP Advisory has valuable experience and experts in the field of projects and transactions of takeovers, mergers and acquisitions, especially of financial institutions – mainly banks. These services include financial and accounting, audit and legal support related to planning and executing capital merging (M&A), and overview of the targeted company/financial institution for potential M&A transaction, through due diligence and business analysis of company/financial institution by comparison to similar companies in the region.

WEIP Advisory was involved in the number of either realized or potential transaction of acquisition of bank, assets or liabilities under temporary management and microcredit organizations in Croatia, Bosnia and Herzegovina, Serbia, Montenegro, Macedonia and Kosovo. We were advisors on many projects of potential M&A of banking sector in Federation BiH.

Privatization tenders advisory services (in cooperation with domestic or foreign partners and charted auditor)

WEIP Advisory offers advisory services on tenders for privatization (public invitation for presenting offers) on the seller’s side – privatization agency, if selected as consultants, or on the buyer’s side for the potential buyer.

Services provided to the buyer on the privatization tender include: due diligence of targeted company; preparation of due diligence report and company's valuation; negotiations with the seller; preparation of preliminary offer and final offer, if abovementioned is selected among the best; and additionally, if final offer is accepted, negotiation on transaction closing and preparation of documentation needed.

We have been involved in privatization projects in Serbia, on the seller side, in the process of privatization of aluminum and chemical industry, and on the buyer side, in the process of privatization of metal processing company+

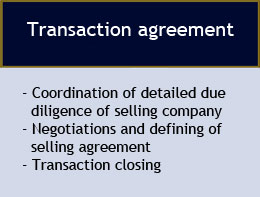

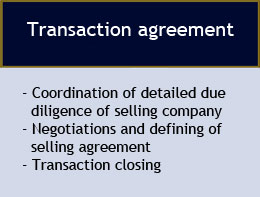

Other M&A transactions: spin-off/disinvestment, MBO, MBI and LBO

Other M&A transaction services offered by WEIP Advisory include: disinvestment through the sale of non-core assets; spin off and splitting of company. Special group of services includes leveraged financing – MBO, MBI and LBO transactions.

WEIP Advisory in cooperation with VABA bank, successfully realized MBO for the medium sized IT company.

LEVERAGED TRANSACTIONS: MBOS & LBOS

- Acquisiton structures where multi - asset entity borrows heavily with intention to repay or refinance in relatively short period through cost savings or asset sales

- Famous for squeezing extra debt capacity via mezzanine and high return bond financing

RestructuringCompany’s restructuring includes diagnostic overview, financial restructuring, organizational and operative restructuring and ownership restructuring.

We have been advisors on organizational and business (operative and financial) restructuring of a number of medium sized companies and ownership restructuring of a number of small companies.

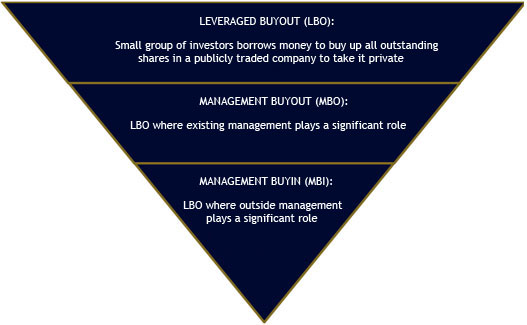

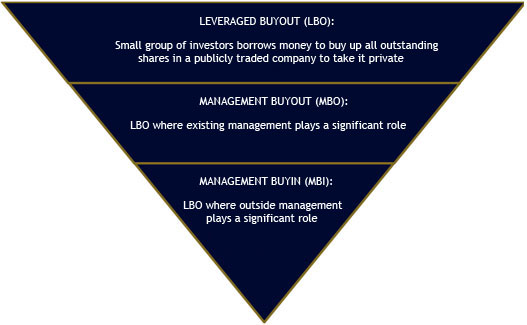

Financial restructuring

Financial restructuringFinancial restructuring includes balance sheet restructuring, apropos changes in the structure of permanent and working capital, as well as liabilities and debts. It also includes liquidity management, non-core assets sale, negotiations with suppliers, banks and other creditors, reprogramming and refinancing of debts, write offs and transforming debts to equity.

Business restructuring (organizational and operational) Organizational restructuring involves organization and management changes. It includes restructuring organizational functions, internal organizational relations, forming profit centers and strategic business units etc.

Operative restructuring relates to marketing, production/sales processes, technology, costs, management system enhancement (planning, informing, controlling), employees (professional and educational structure changes) and IT.

Ownership restructuring Ownership restructuring includes changes of company’s owner in different ways: conversion of debts and payables into equity shares, share swaps between mother company and subsidiaries, management and employee buy-out (MEBO and ESOP programs) etc.

Project financing Services relating to project financing include: advising municipal authority, central government and private investors’ possibilities for financing infrastructural projects; analysis of different financial models (loans, municipal bonds, public private partnership etc); selection and elaboration of financial model, transaction structure and documentation relating to transaction; and coordination of activities among investors, banks/financial institutions and consultants. Our experience in project financing involves: advising on concession agreement and preparation of financial model for some highways in Croatia; advising in PPP project on construction of waste management facility; and preparation of financial model together with feasibility studies on the project of hotel complex and aqua park construction

Financial models for infrastructural project Financial models for infrastructural project relate to transport infrastructure (motorways, ports, airports, railways).

Financial models for tourism projects Financial models for tourism projects relate to tourism infrastructure (hotels, thermals and aqua parks, golf fields).

Financial models for other projects (public buildings, energy)Financial models for other projects relate to energy infrastructure (renewable energy sources, electric power plant, oil and gas pipeline, LNG terminals, mining) and public infrastructure (schools, hospitals, prisons, stadiums and water projects).

Capital marketsExperience on capital market services, in cooperation with authorized investment company, include: IPO advisory for two closed end investment funds (equity and real estate); advisory on stock exchange listing for a number of companies from textile, construction, metal, assembling, brewery, agricultural and financial sector (we highlight first listing on first and second quotation of former Varaždin Stock exchange (later merged to Zagreb Stock exchange), as well as the fact that we were among three advisors with highest number of listings in former PJSC quotation on Varaždin SE); advisory on acquisition of chemical, food, optical and textile companies.

Financial position analysis of potential issuer and structuring securities’ issuePotential issuers of securities are the government or municipal authority (government and municipal bonds), joint stock company (commercial papers, corporate bonds and shares). Financial position analysis, depending on the type of issuer, includes projections and analysis of the budget or financial statements. A suggestion on the structure and the amount of the issue is presented in the feasibility study on securities’ issue.

Securities issue through public and private offer IPO (“Initial Public Offering”) relates to public offer and listing of company’s shares on the stock exchange. IPO is a very popular way of attracting new capital for companies that need funds to increase turnover, by selling equity shares to investors that believe in company’s future development and growth. IPO presents a transformation from closed into public company.

IPO is a very demanding process that includes: company’s preparation; documentation review performed by Croatian Financial Services Supervisory Agency (CFSSA); marketing preparation and distribution of prospectus; presentations for road show; making decision on IPO price; transaction closing; and post IPO share movement monitoring.

IPO Process flow

Securities listing on stock exchange

Securities listing to stock exchange relates to quotation listing (Prime market) on Zagreb stock exchange or some other foreign SE. Services include advisory, communication with Croatian Financial Services Supervisory Agency and preparing documentation for listing (prospectus and teaser).

Takeover advisory services

Takeover advisory services includes: current ownership structure overview; negotiations; share price determining; buy back of key shareholders’ shares; all in cooperation with investment company as intermediate in announcing takeover offer.

Other

Other services include feasibility study preparation for special projects: Croatian pension transformation – second and third pillar (mandatory and voluntary pension funds); holding company and closed end real estate management investment fund; establishing regional financial group; municipal authority consulting – preparation of documentation for county development; analysis and optimization of business processes in financial holding, investment fund management company and brokerage house; preparation of risk measurement system Value-at-Risk for the bank and investment fund management company

Municipal authority advising

Financial capabilities analysis – financial analysis of generated revenues and cost control to establish financial equilibrium, by calculating relevant financial indicators (group of indicators - revenues, expenses, variances from budgeted, relative growth, liquidity, indebtedness and debt repayment) and comparison with the benchmark. Finding revenues not fully utilized and possible cost effective measures, prepare suggestions for budget optimization (simulation of few scenarios) as supporting tool for budget projection.

Preparation of guidelines for improvements in assets management, after review of documentation relating to real estate and financial statement of municipal companies, to find internal reserves potential of the assets (mainly real estates and equity shares). The aim is to establish optimum assets management and increase budget income from assets (rent, interest in municipal companies’ net result) and sale of non financial assets, decrease in budget expenses relating to asset management (maintenance cost, subsidies and service cost of municipal companies).

Assistance and support in preparation of strategic development documents for municipal authority units – in compliance with European Commission, with the purpose of selection and valuation of development project acceptable for co-financing from international and/or national subsidies.

Assistance and support in preparation of project applications – for co-financing from EU and government funds, for opened tender from IPA program, as well as for announced activities of IPARD program.

Feasibility study – special projects

Services of preparing feasibility studies for projects related to investment banking and other pre investment studies for different projects with emphasis on financial sector (banks, funds, fund management companies, holdings).